gift in kind receipt

In these page we also have variety of images available. What to do if a charity receives stock donations.

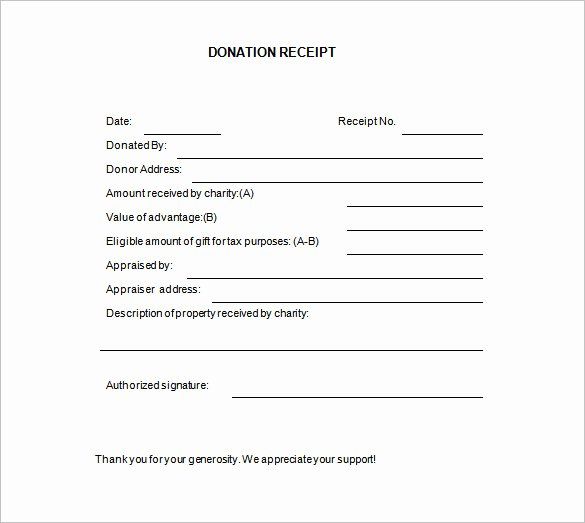

Explore Our Image Of In Kind Donation Receipt Template Receipt Template Donation Letter Template Teacher Resume Template

In this case you should send a donation receipt comprising details such as the ticker symbol the number of shares and the donation date.

. Therefore the advantage must be less than 400 for a receipt to be issued. According to GAAP guidelines the IRS requires tax receipts be provided for gifts of 250 or more. When it comes to in-kind donations you dont have to value the gift yourself.

Flowers for an auction. The following calculations are used to determine the eligible amount of the gift for receipting purposes. Church Letter for Receipt of Gift-in-Kind.

Name of the organization. Not only are the written acknowledgment requirements complex especially. In Kind Gift Receipt Template The In Kind Gift Receipt template is available on PA Docs database.

The invoice appraisal less GST if donor is GST registered. The written acknowledgment required to substantiate a charitable contribution of 250 or more must contain the following information. Brand Resources and ACS Legal.

In-Kind Gift Receipt Policy Number. Statement that no goods or services were provided by the organization if that is the case. We sincerely appreciate your generosity in giving this material donation so that others might benefit.

In-kind donations for nonprofits can be made by individuals corporations and businesses. Services like pro-bono consulting repair work. Generally a donor may deduct an in-kind or non-cash donation as a charitable contribution.

Based on donors estimation not Foundation Communities. May 2010 Most recent review. Gift In Kind Acknowledgement Letter.

For non-cash donations gifts-in-kind a charity must issue a separate receipt for each gift. According to the IRS any kind of donation above 250 should require a donation receipt. NA Policy Statement Prior approval must be obtained from the FLCC Foundation Inc.

Your gifts allow us to provide needed resources and support for other Christian nonprofits. However charities are encouraged to inform the donor that this is their policy when they receive a donation. The donations must be entered with exactly Gift in Kind in the Cheque Paid By field and must have a description of the gift in the Description field.

In these page we also have variety of images available. Yes you are the recipient of a very generous In-Kind gift. DATE NAME OF DONOR ADDRESS CITY STATE ZIP PHONE EMAIL Yes I would you like to receive emails about Mission news stories and events.

In-kind donations for nonprofits can be made by individuals corporations and businesses. 5 25 HEB Gift Cards Please provide a list of items donated. Its utilized by an individual that has donated cash or payment personal property.

After a Gift In Kind non cash donation is received directly by UW Madison from a donor the campus department is responsible for issuing a GIK donor acknowledgment letter to the donor and keeping a copy on file. To help you develop your gift receipts. K-4 Responsible for Policy.

It is an acknowledgement provided to the donor only upon receipt of the gift. Just provide the receipt with the description of the donation and other basic information. Therefore the advantage must be 50 or less to be considered de minimis.

Donation merchandise from inventory - a charity may issue an official tax receipt to a business for the fair market value of merchandise gifts out of inventory ie. Some examples of in-kind donations are. In-kind donations are non-cash gifts made to nonprofit organizations.

The receipt will clearly indicate that the donation is a Gift-in-Kind. CRA does allow registered charities to issues receipts for in-kind donations where the donation is a physical item or property See the CRA definition of property here The receiptable amount of a. Physical items like sports equipment food office supplies.

In Kind Gift Receipt In Kind refers to donations of goods instead of cash. Foundation Communities certifies that no goods or services have been given in exchange for this gift. Many charities in Canada prefer not to accept Gifts in Kind called non-cash.

For in-kind donations the donor has the responsibility to value the donation. This sample receipt is for a gift-in-kind where the donor did not receive any benefits in return. Donation Receipt FAQs 1.

Yes provided the receipt is for cash donations only. Debit the fixed asset account Portable Building In-Kind 12000. When a donation of equipment services or tangible goods to the College is.

Description but not value of non-cash contribution. In Kind refers to donations of goods or services instead of cash. This is a sample receipt for a gift-in-kind where the donor received benefits as a result of their donation.

That is to simply and gratefully acknowledge what you understand was the expense paid for by the corporation. And a donor must obtain a written acknowledgment from the charity to substantiate the gift although the acknowledgment will generally not assign a dollar value to the donation. 80 of 500 is 400.

Credit the In-Kind Contributions 12000. In-kind donation receipts. The same applies to stock giftsdonations.

Lincoln NE 68508. Please note according to IRS regulations establishing a dollar value on donated items is the exclusive responsibility of the donor. Assuming that your organization has a policy to capitalize assets of this value you would record this gift in-kind like this.

Whether you have receipts to the penny or if you know from other valid references regarding the expense paid for by the corporation you treat such gifts in the same way. In Kind Gift Receipt In Kind refers to donations of goods instead of cash. Amount of cash contribution.

Consult a lawyer or. Donation Items Estimated donation amount. You just need to input the company or individuals basic details including their contact numbers and addresses.

They are receipted separately using the menu options on the Receipt Gift in Kind Receipts sub-menu. The value of the in-kind donation in question. 5 25 HEB Gift Cards Please provide a list of items donated.

Information in this module is provided for general educational purposes and not as legal or accounting advice. In Kind Gift Receipt. Please list the number of gift cards by type and dollar amount.

CompanyIndividual Company Contact Address CityStateZip. Donated services are not tax deductible. 10 of 500 is 50.

Another business donates an air conditioner valued at 800. Many charities will do this. Fall 2012 Date of most recent revision if applicable.

In Kind Gift Receipt. In Kind Gift Receipt Template The In Kind Gift Receipt template is available on PA Docs database. It also helps donors in they need to claim a tax deduction for gifts more than 250.

Explore Our Sample Of Gift In Kind Receipt Template Receipt Template Donation Form School Donations

Get Our Image Of Gift In Kind Receipt Template Receipt Template Marketing Strategy Template Sales And Marketing Strategy

Explore Our Sample Of Gift In Kind Donation Receipt Template Receipt Template Donation Letter Letter Templates

Browse Our Free Charitable Donation Receipt Template Receipt Template Donation Form Non Profit Donations

Get Our Image Of Gift In Kind Donation Receipt Template Donation Letter Template Receipt Template Donation Letter

Explore Our Sample Of Gift In Kind Receipt Template Receipt Template Donation Form School Donations

Get Our Printable Tax Deductible Donation Receipt Template Receipt Template Receipt Tax Deductions

Browse Our Sample Of Charitable Contribution Receipt Template Silent Auction Donations Auction Donations Donation Letter Template

Printable Gift Receipt Templates Receipt Template Printable Gift Receipt

Explore Our Image Of Salvation Army Donation Receipt Template Receipt Template School Donations Salvation Army

Explore Our Example Of Gift In Kind Receipt Template Receipt Template School Donations Non Profit Donations

Browse Our Example Of Non Profit Donation Receipt Template Donation Form Receipt Template Donation Request Form

Explore Our Printable Gift In Kind Donation Receipt Template Receipt Template Donation Letter Non Profit Donations

Donation Form Template Word Elegant Blank Receipt Template 20 Free Word Excel Pdf Vector Receipt Template Donation Letter Template Donation Letter

Explore Our Image Of Car Detailing Receipt Template Receipt Template Free Receipt Template Receipt

Explore Our Sample Of Charitable Contribution Receipt Templat Charitable Contributions Charitable Receipt Template

Printable Gift Receipt Templates Receipt Template Printable Gift Templates

Charitable Donation Form Template Luxury Charitable Donation Receipt Letter Template Sampl Receipt Template Printable Letter Templates Donation Letter Template